Tax cheats Exxon won't pay tax until 2021

Gas giant drops bombshell during fiery Senate grilling.

Senators from the Corporate Tax Avoidance Inquiry took Exxon bosses to task over the company’s tax minimisation arrangements, and their treatment of local workers.

Exxon has pushed out 230 skilled maintenance workers from their on and off-shore operations for over 280 days. The workers refuse to accept Exxon’s 30% pay cuts and grueling anti-family roster. Members and families travelled from Sale to Melbourne in mid-March to hear our nation’s leaders tell Exxon exactly what they thought.

Exxon Chairman Richard Owen, who began his working life at Esso’s Longford Plant, revealed to the lawmakers that his company does not expect to pay any tax until 2021. That would mean Exxon paid zero corporate income tax for eight years, on over $50 billion in sales.

How they do it

Exxon avoids tax by making a paper loss. Like other resource companies, they probably shift their profits overseas through loan repayments to other Exxon subsidiaries, and through phony internal charges from Exxon Singapore.

Unfortunately, Exxon refuse to tell the Australian public exactly where the money goes and how.

The one thing we do know is that they’re making billions and paying nothing.

If Exxon had paid tax on their billions in revenue at the same rate as their nearest competitor, Woodside Energy, in just the last three reported years, then Australia would have received $1.4 billion. That’s enough for over 16,000 nurses, 21,000 teachers and 37,000 paid apprenticeships.

Exxon boss doesn’t know who owns him

The under-fire Exxon executives were also asked why they mislead the Senate in 2015, failing to tell the last tax avoidance inquiry that their Australian company is owned in the Netherlands, and that the company is itself owned in the Bahamas.

When asked why an Australian resources firm would be owned through the Netherlands and the Bahamas, the bosses couldn’t answer. Zeroing in on the Dutch connection, Labor Senator, Kimberly Kitching, asked if Mr Owen had met the three Dutch shareholders, who are nominally his bosses. He hadn’t. She asked if he knew who they were. He did not. But surely he knew of them? Their professions? He couldn’t say.

Senators tore strips off the bosses over not knowing their own ownership structure, because that structure could aide them in avoiding corporate income tax.

Labor Senator and former ETU Victoria Assistant Secretary, Gavin Marshall, cut in “Surely you know who owns you!?” to laughter from the audience.

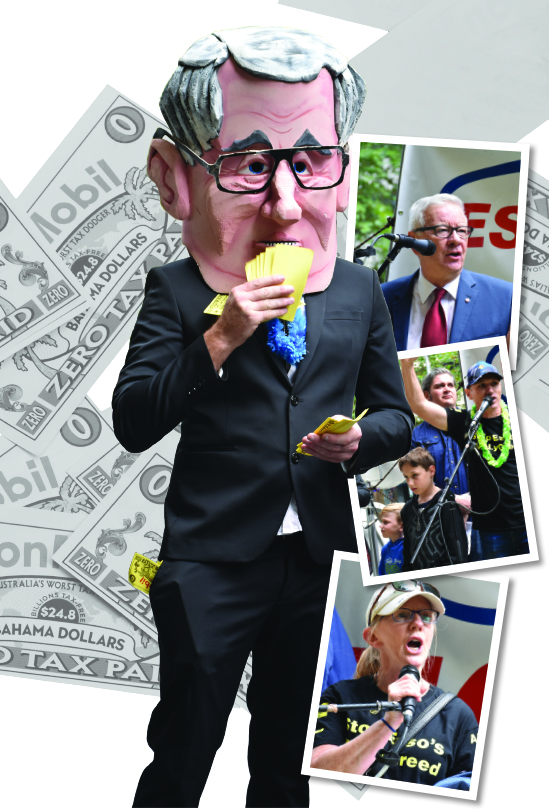

Families get their day at "Make Exxon Pay" Rally

Several hundred people rallied at Melbourne’s Intercontinental Hotel on Collins Street. The members and families from Gippsland organised the rally outside the Senate hearing to protest Exxon’s greed towards workers and taxpayers.

The lively ‘Exxon are Pirates (of the Carribean) Rally’ featured Jack ‘Exxon’ Sparrow, palm trees, inflatable animals, and a briefcase full of Exxon’s tax-free Bahama dollars. The rally’s Caribbean theme highlighted Exxon’s use of the Bahamas as a tax haven to avoid paying tax in Australia.

Speakers included AMWU Delegate and Esso/UGL fitter, Troy Carter, with his family, and Vanessa Britton who is the wife of AWU member and scaffholder, Mick.

Labor’s Lisa Chesters delivered a fiery message from Bill Shorten that using dodgy contracts to cut the wages of workers across the country would be outlawed under the ALP.

Senators Chris Ketter and Doug Cameron reported back to the crowd after hearing from Exxon at the Senate Inquiry inside.

Senator Cameron fired the crowd up by revealing boss Richard Owen had told Senators he was “very proud” of the way Exxon was treating workers. The Senator lambasted the way the company let their contractor, UGL, use a dodgy EBA negotiated by just five workers in Western Australia to cut the pay and conditions of Victorian workers.

Senator Cameron said he would meet with the company in person to ask them to drop their pay cuts campaign.